Recently, Johnson & Johnson opened up at the J.P. Morgan Healthcare Conference. They announced a new development of acquiring Intra-Cellular Therapies. This is a New York City-based biotech firm that develops & markets drugs for the central nervous system. The deal was worth $14.6 billion at $139 per share with a 39% premium. The 23-year-old Intra Cellular Therapies was on an upward swing. Its market cap doubled by the end of 2022. Its reported revenue was $481 million for Q1, Q2, and Q3 of 2024. This is important for Johnson & Johnson, looking at the growth of the brand Caplyta (Lumatiperone) by 45% year-on-year sales. Caplyta is used to treat bipolar disorder and schizophrenia. It is also set to gain approval for treating major depressive disorder. This acquisition aims at strengthening J&J’s neuroscience portfolio further.

Details of the Acquisition

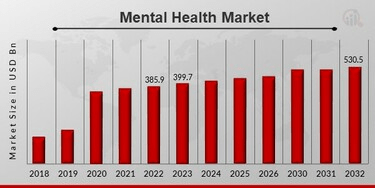

The global neuroscience or mental health therapeutics market is now valued at $410 billion. It is expected to reach $523 billion by 2033 at a CAGR of 3.4%. Based on the disorders, the market is classified into several categories. These include depression, bipolar disorders, schizophrenia, anxiety, post-traumatic stress disorders, alcohol abuse, and other disorders. Among these, depression is considered the largest market. Looking at this, acquiring Caplyta is crucial for J&J. It is a commercially viable drug. This holds true if Caplyta receives FDA approval for major depressive disorder (MDD) treatment. This can give J&J with a major revenue stream and generate peak sales of around $ 5 Billion per year

Why is Caplyta Important?

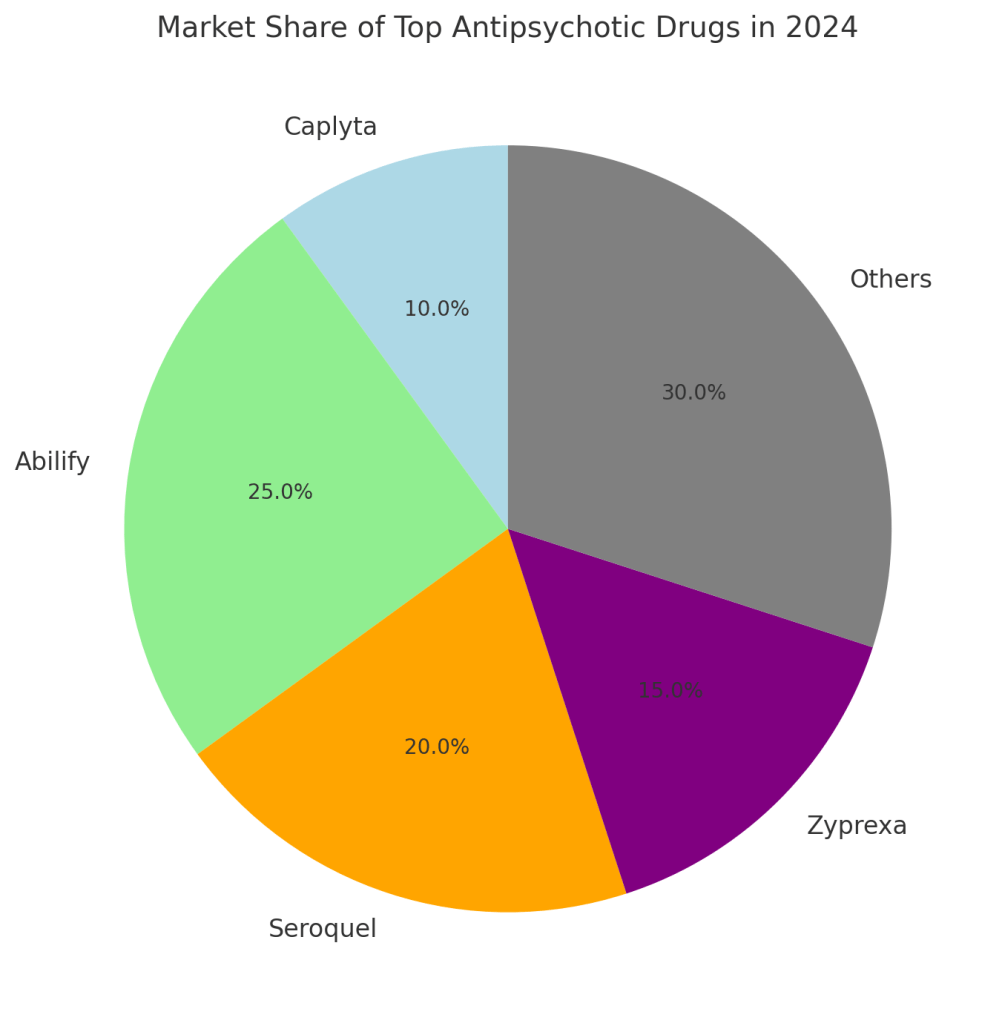

Lumatiperone, also marketed as Caplyta, is an effective antipsychotic drug that is used to treat bipolar disorders & schizophrenia. The drug is specifically highlighted for its safety and efficacy. It has a favorable metabolic profile. The drug shows success in various clinical trials compared to traditional antipsychotics like Abilify and Seroquel. After this, the trials going on for Major Depressive Disorder (MDD) promise that Caplyta is a potential acquisition for J&J to increase its neuroscience portfolio and business

Data Point: Caplyta now holds 10% of the global antipsychotics market, expected to rise to 15% by 2027.

J&J’s Neuroscience Strategy

J&J has been trying to invest more to enhance its neuroscience business. It leverages scientific advances in data science, human genetics, biomarkers, and digital health. The company aims to compete with other giants like Pfizer and Novartis globally. It has done significant work in Alzheimer’s, Parkinson’s, and other mental health therapeutics. In this scenario, acquiring Intra Cellular Therapies is highly lucrative. Adding Caplyta to J&J’s kitty of antipsychotic products is beneficial for revenue growth.

Market Trends & Future Implications

This acquisition affects the trends in the Pharmaceutical industry which includes:

- A shift to personalized medicine – With acquisition of targeted therapies like Caplyta, J&J addresses needs of specific patient population

- Expansion of Pipeline – The acquisition also includes ITI-1284. It is a promising compound being studied for generalized anxiety disorder (GAD). It is also being examined for Alzheimer’s disease-related psychosis and agitation. This provides J&J with further opportunities to expand its mental health portfolio

- Consolidation in Pharma—The M&A helps J&J lead innovation and leadership trends in the pharmaceutical industry.

Regulatory & Compliance Considerations

The acquisition of Intra-Cellular Therapies by Johnson & Johnson (J&J) is a significant deal in the pharmaceutical industry. Here are some key regulatory and compliance considerations:

- Regulatory Approvals: The acquisition will need to be reviewed by antitrust authorities in various jurisdictions. This includes the United States (Federal Trade Commission or Department of Justice). There is also a potential review by the European Union or other countries where J&J and Intra-Cellular Therapies work. These agencies will evaluate how the merger affects competition in the relevant markets.

- Shareholder Approval & Disclosure Requirements: Both parties need to guarantee compliance with securities regulations related to shareholder communications. And both parties need to make required disclosures to regulatory bodies like the Securities exchange Commission (SEC) about financial details & risks

- Healthcare Implications: Both parties are to comply by FDA regulations & acts like the sunshine act to guarantee transparency and ethical practices

Conclusion

J&J’s acquisition of Intra-Cellular Therapies is a significant move. It aims to map the global mental health therapies market. This market is growing fast at a CAGR of 3.4%. J&J aims to tackle specific patient population needs with novel remedies. With Caplyta as a major cornerstone asset, J&J is poised to change it’s global Neuroscience portfolio as well as give safe, innovative and efficient solutions for treatment of mental diseases

Leave a comment