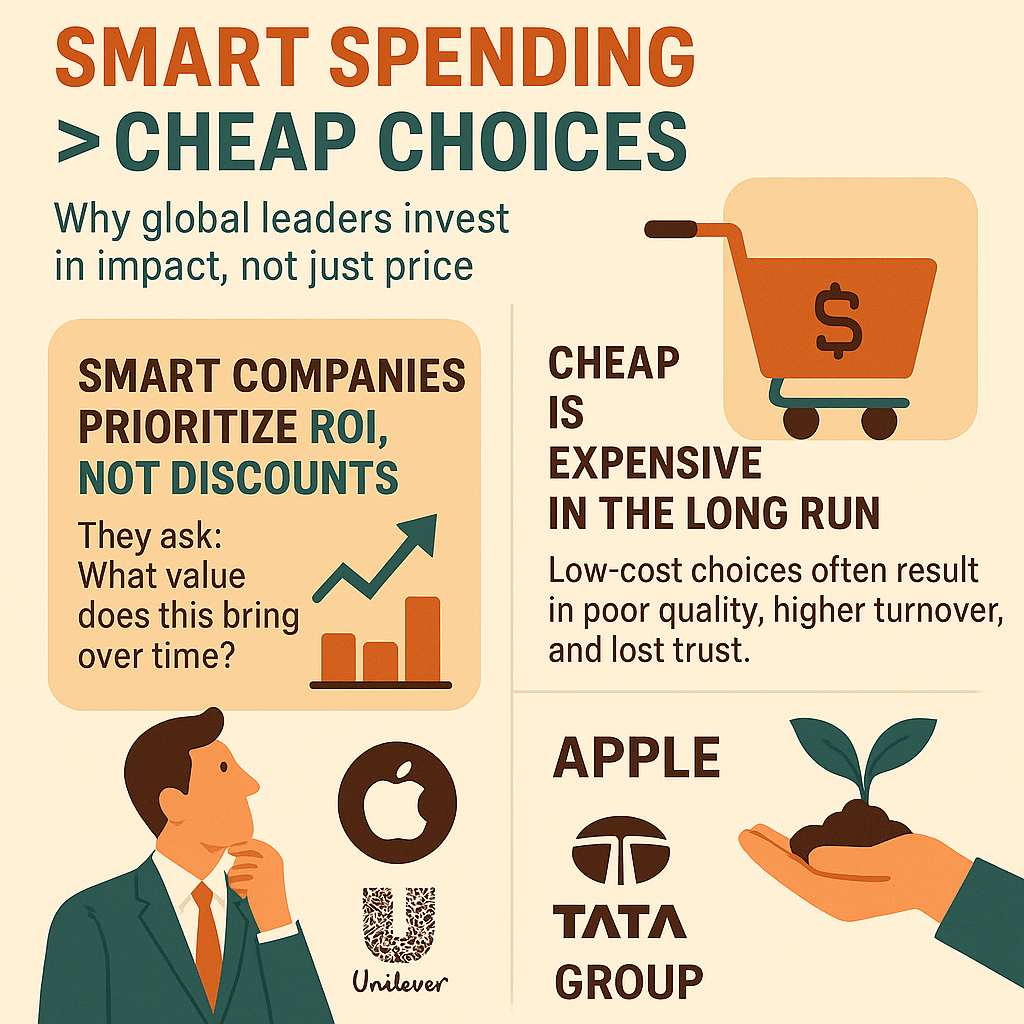

In a world that is so dynamic and competitive, most global corporations are driving sustainable growth by making smart spending choices. They have targeted focusing on negotiations based on the ROI they would generate or specific purchases or activities rather than negotiating for the lowest pricing. And this trend isn’t just ideological. It’s backed by hard data and real-world success stories from global leaders like Apple, Unilever, and Tata Group.

Apple: $4.7 Billion for a Greener Supply Chain

Apple is setting a very high standard for how strategic investments can yield long-term returns — financially and environmentally. The company has issued over $4.7 billion in green bonds, supporting renewable energy and carbon removal projects globally. Its bold target: a 100% carbon-neutral supply chain by 2030.

These funds have helped create over 18 gigawatts of clean energy, enough to power millions of homes. But more importantly, Apple is pushing its suppliers to follow suit, reinforcing sustainability through the value chain. The result? Enhanced brand equity, regulatory readiness, and stronger investor confidence.

Lesson: Investing in a clean supply chain provides a long-term competitive advantage rather than being a mere cost.

Unilever: Purpose-Driven Brands Outperform

Unilever has long championed sustainability and ethical sourcing, and the payoff is measurable. The company reports that its Sustainable Living Brands — those taking action on social and environmental issues — grew 69% faster than the rest of its portfolio and contributed 75% of overall growth.

This includes brands like Dove (promoting body positivity) and Ben & Jerry’s (advocating for climate justice), which invest in sustainable sourcing and fair trade. Consumers are rewarding purpose-driven spending with loyalty, advocacy, and higher engagement.

Lesson: Value-driven spending not only reduces risk but also unlocks consumer trust and growth.

Tata Group: Investing in Local Impact

India’s Tata Group demonstrates how smart spending can be a vehicle for inclusive growth. Rather than outsourcing or minimizing costs, Tata invests heavily in local supplier ecosystems, education, and rural development. Through Tata Trusts and business operations, the group has worked on more than 5,000 grassroots initiatives — from healthcare to sustainable agriculture.

In sectors like steel, automobiles, and consumer goods, Tata often partners with state governments to build capacity rather than cut corners. This has not only built deep trust in local markets but has also created scalable, socially responsible business models.

Lesson: Long-term investments in people and partnerships build resilient supply chains and a stronger market presence.

Let us look at the bigger picture here:

Smart spending is powering the circular flow in the economy. Smart spending that focuses on building better products and a sustainable revenue channel creates new jobs and helps in community building. This, in return, encourages innovation and helps reduce long-term costs by focusing on sustainable and efficient solutions. And in return funds the circular economy that pumps money back into the ecosystem.

Our Conclusion is

In a VUCA world, the cheapest solution is often the most expensive one. Global leaders are proving that strategic investments in sustainability, people, and partnerships yield superior returns — financially and ethically.

Smart spending isn’t a luxury — it’s the foundation of sustainable business success.

Leave a comment